Table of Content

We, at Bank of India, are committed to become the bank of choice by providing superior, proactive, innovative, state-of-art banking services with an attitude of care and concern for the customers and patrons. The need to disclose one’s permanent account number has become essential in almost all financial transactions. But, when it comes to quoting bank’s PAN to avail certain tax benefits on home loan, not many could be aware of the same.

Renovating your home can be a costly affair, but our home improvement loan can turn your dream home into reality. Bank of Baroda deposit plans offer convenient solutions to both working individuals as well as senior citizens. These deposits are categorised into deposits with a term period of less than 12 months, more than 12 months and recurring deposits.

Where can I find the home loan PAN number?

In the case of a married couple, one of the spouses, or both of them together in shared possession, would be liable for a single home, based on the household’s income eligibility under the programme. This type of loan is specially established for EWS/LIG families under MIG-I and MIG -II categories. The validity of this scheme is up to 31 march 2022 (EWS/LIG), 31 march 2021 (Families under MIG-I and MIG -II categories). Purchase a flat, row house, bungalow in India from private developers in approved projects. The applicant must be between the age group of 18 years to 65 years. We'll ensure you're the very first to know the moment rates change.

What is the maximum loan amount that has to be borrowed under the Bank of India Star Home Loan scheme? Under the Bank of India Star Home Loan scheme, an applicant will be able to avail up to Rs.500 lakh for the construction or purchase of a housing property. The loan amount will be subject to the geographical location of the property. In addition to that, applicants can also avail loans for the renovation, extension, or repairs of an existing housing property. As mentioned in the table above, a minimum credit score of 675 is ideal for availing a home loan from Bank of India.

Why do you require each bank’s PAN number?

The term for the loan will under no circumstances exceed the age of retirement or completion of 65 years of age, whichever is earlier. B3 Silver Account comes with maximum savings and zero Quarterly Average Balance . Also, make the most of coins and annual offers from Loyalty Rewardz to fulfill yearlong subscriptions and shopping. Photocopy of your ID card provided by the present employer, duly attested.

Non-Resident Indian , Person of Indian Origin , Overseas Citizen of India are the individuals eligible for Bank of India home loans. Many Indians staying overseas wants to buy properties in India. Everyone satisfying the Bank’s basic criteria are eligible for Bank of India Home loan be it a salaried person or a self-employed person or an NRI or even a PIO. They provide a better scheme regarding EMIs, which are low due to fixed low-Interest rates on this loan. Anyone can avail this home loan scheme irrespective of their income, nature of employment and age group.

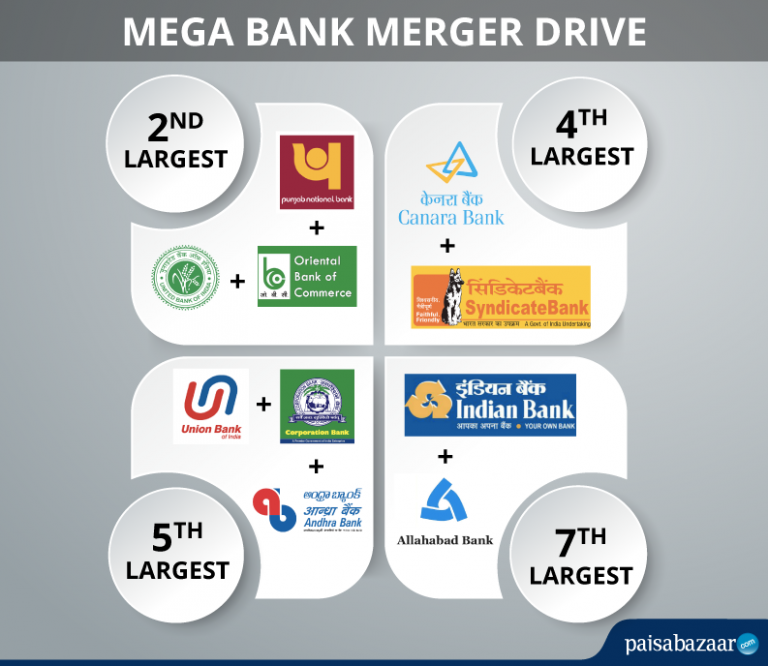

PAN Numbers for Home Loan of All Banks

However, to complete the process, one must provide the PAN Card number of their respective lender bank to the Income Tax Department. In addition to such details, one has to furnish the PAN of the lender as well. Here is a list of banks with their PAN to help you furnish complete details to your employer. Certified copies of Balance Sheets and Profit and Loss accounts, IT acknowledgments, advance tax challans (for both company/firm and personal account) for the last three years in case of self-employed applicants. Baroda Pre-Approved Home Loan provides in-principle approval for home loan, prior to identification of a specific house/flat/plot, giving the customer greater flexibility in negotiations with builders/sellers.

Even the processing of the application is done quickly enough that your home loan gets approved without any unnecessary delay. The maximum amount a person can pay as an EMI installment is 65% of his or her monthly income in their EMI scheme. A person must be 21 years minimum to take a Home loan from Bank of India and not more than 60 years of age.

A cheque for every service being performed by the bank for the applicant. Applicant fulfilling all of the above-listed requirements is eligible for Bank of India Star pravasi home loan. Similarly, people who had Indian passport at their disposal but now they have another country’s passport eligible to be recognised as Person of Indian origin. Also, foreign citizens having either of their great-grandparents or parents or grandparents who were born in India and were permanent residents of India are given the status of People of Indian origin .

This link is provided on our Bank’s website for customer convenience and Bank of Baroda does not own or control of this website, and is not responsible for its contents. The Website/Microsite is fully owned & Maintained by Insurance tie up partner. This facility is for customers who do not have account with Bank.

A representative of the Bank of India or an online partner can contact you to discuss eligibility for your loan as well as rates, terms, processing costs and other expenses. We have mentioned the list of all the banks like SBI PAN Number, HDFC PAN Number, and several other banks’ PAN numbers. You can read the lists and use the PAN number for your tax exemption while filing the Income Tax Returns. Urban Money is India’s one of the unbiased loan advisor for best deals in loans and unmatched advisory services.

This scheme helps the borrowers to get additional funding over their already opted home loan. The funds from this scheme can be used for various personal and business purposes. Complete the sum, property detail, personal details, job data and contact number of a licenced online channel partner’s web site, division, or website in the application form. For the loan amounts listed in the table below, the loan repayment tenure is assumed to be 30 years and the rate of interest is assumed to be 6.85% p.a.